Car Loan With 600 Credit Score And Cosigner

Your actual rate depends upon credit score loan amount loan term and credit usage and history and will be agreed upon between you and the lender. What Credit Score Do You Need to Get an Auto Loan.

3 Auto Loans With Cosigners Optional 2021 Badcredit Org

With either of these two options theyre able to go in and obtain the vehicle of their choice depending on how much they were approved for.

Car loan with 600 credit score and cosigner. Many first time buyers may find this a difficult requirement to meet but the good news is youll need just 6 months income history. A cosigners credit is the best way to help you be approved for a joint loan. The lender is taking both applicants credit history and financials.

Auto lenders largely use your credit score to determine your creditworthiness. The loan terms included in this chart are for 3 years 36 months 5 years 60 months and 7 years 84 months. Without their good credit you may need to get an auto loan on your own.

To get a car loan you might need a co-signer with a good credit score. Apply for 530 Credit Score Auto Loan with Cosigner. In the VantageScore 30 model a credit score of 600 is considered poor Both models use a range of 300 to 850 and a 600 credit score with either model is below what lenders tend to view as good credit.

All loan payment amounts are based on a new car loan APR interest rate of 752 for non-prime borrowers with a credit score of 600 to 660. So what credit score does a cosigner need. When you apply for an auto loan with a cosigner their credit score does matter and so do a few other things.

People with 600 credit score generally can get approved for a car loan as long as they have steady income that they can prove or if they have a co-signer. For additional loan options please call 800-339-4896. To be a cosigner for somebody with less than perfect credit the person youre asking must have good credit at least a 660 credit score a minimum income of between 1500 and 200 a month and enough available income to comfortably make the loan payments.

Checking Your Cosigners Credit Score. Its a nice gesture but also a huge responsibility that comes with a major risk. And as an added bonus you should qualify for lower interest rates.

These products can be a good option to cover various unplanned and larger expenses but there are challenges low credit borrowers will face in getting approved. If the primary borrower cant pay the cosigner has to If you miss a payment or default on the loan your cosigner becomes responsible for paying it. A potential cosigner should have a good credit score.

The credit score you need to get a car loan isnt set in stone. The question of whose credit score is used on a joint auto loan is probably one of the most important. Lenders will review the information provided by you in your request form.

It becomes more difficult to get an auto loan with a credit score below that but not impossible. And with a good credit score next time you need a loan you may not need a cosigner. Having no credit disqualifies you from getting most unsecured loans as lenders usually require an established credit score of 600 or higher.

Incomes can be combined but credit scores unfortunately cannot. Does my credit score matter if I have a cosigner. If you need a bad credit car loan but dont think youll get approved a cosigner.

Almost all lenders of first time car loans set a minimum monthly income requirement at 1600 as a requirement for not needing a cosigner. An example of total amount paid on a personal loan of 10000 for a term of 36 months at a rate of 10 would be equivalent to 1161612 over the 36 month life of the loan. Lets go over what you need to know when youre enlisting a cosigner on a car loan.

However speak to your lender about additional loan options for new used or refinancing. The primary loan holder and cosigner share equal responsibility for the debt and the loan will appear on both your credit report and hers. Both applicants will be listed on the loan car.

The primary borrowers actions affect the cosigner When someone cosigns the loan shows up on their credit reports and affects their credit score. If your credit score isnt the best a lender may turn you down for. In addition you must be patient as it can take up to 48 hours time for lenders to.

It also depends on whats on your credit reports or. This translates to 400 per week or 10 per hour paying job. Without them you may not be able to land a loan with favorable terms.

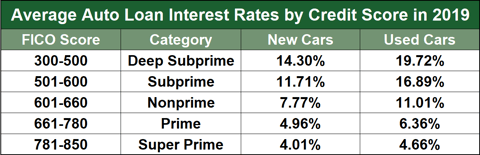

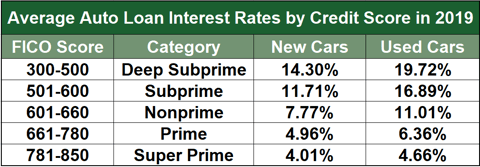

Consumers often ask us about the odds of getting approved for a car loan with a 600-credit score 500-credit score and so on. Deep subprime 300500 Subprime 500600 Nonprime 600660 Prime 661780 Super prime 781850 New. Typically a cosigner needs a good or excellent credit score but requirements vary by lender.

However the truth of the matter is that once your credit score is below 660 youre in the bad credit domain. If you want to get a personal loan with no credit and no cosigner your options are limited to credit-builder loans secured personal loans home equity loans and borrowing from alternative sources like friends and family. A bad credit car loan is a possibility and the companies weve recommended above should be able to help you find a loan if you cant get a cosigner or have a poor credit history.

How Does Cosigning Work. By getting the loan and making your payments on time and in full you are improving your credit score. Car loan rates by credit score.

Thats because auto. Loan Guides Personal Loans Can You Get a Personal Loan With a 600 Credit score. The truth is that it is important for both parties to have an acceptable credit score and payment history.

So make sure that the income details which you provide are correct accurate and fully verifiable as it will have bearing on the type of interest rates that you will be offered. If the primary borrower has a late payment delinquency or repossession each. When asking someone to be your cosigner remember they are doing you a favor.

Yes being a cosigner on a car loan will help you build your credit history. The table below shows the average auto loan rate for new- and used-car loans based on credit scores according to Experian data from the second quarter of 2020. In this guide we will outline the benefits and drawbacks of taking out a personal loan with 600 credit score or lower.

What Credit Score Do I Need To Refinance My Car Loan Rategenius

Things To Remember When Looking For A Co Signer Home Improvement Loans Home Equity Line Mortgage Tips

What S The Minimum Credit Score For A Car Loan Credit Karma

What Credit Score Do You Need To Get A Car Loan

What S The Minimum Credit Score For A Car Loan Credit Karma

600 Credit Score Car Loans 2021 Badcredit Org

Tudents Who Have A Poor Credit Score And Cannot Find A Cosigner Can Apply For The Federal Student Loans From The F Payday Loans Loans For Bad Credit Cash Loans

What Is A Good Credit Score To Buy A Car Most Borrowers Are Above 660

Best New Used Rates With A 510 Auto Loan Credit Score 2021

How To Find A Cosigner For A Car Loan Yourmechanic Advice

5 Minute Template To Dispute Credit Report Letter Peer Finance 101 Dispute Credit Report Credit Dispute Lettering

How A 600 Credit Score Will Ruin Your Life And How To Change It Finance Credit Score Bad Credit Score Scores

How To Get A Car Loan With Bad Credit Credit Karma

Average Auto Loan Rates Credit Repair

Ways To Avail Car Loans For Credit Score Under 600 Read What You Can Do Best New Cars Best Car Insurance Car Insurance

Best Auto Loan Rates With A Credit Score Of 610 To 619

Comeback Tips To A Happy Credit Report Check Credit Report Improve Credit Check Credit Score

600 Credit Score Car Loans 2021 Badcredit Org

21 Simple Steps To Fix A Bad Credit Score Fast Bad Credit Score Fix Bad Credit Loans For Bad Credit

Post a Comment for "Car Loan With 600 Credit Score And Cosigner"