Car Lease Tax Nyc

In car leasing as in buying there can be charges fees costs and taxes that often surprise newcomers. The new tax period will be June 1 to May 31 and the full 400 payment will be due by June 20.

Car Leasing Pro 225 5th Avenue New York Ny 10001 646 930 7399 Car Lease Lease Lease Deals

Depending on where you live leasing a car can trigger different tax consequences.

Car lease tax nyc. Plus BMWFS and MBFS and perhaps some others will allow MSD if you lease out of state. When you lease a car for your business you can deduct the mileage and actual expenses such as monthly payments interest tax upkeep and maintenance including inspections oil changes new brakes and tires. It is possible to deduct 100 of your business leasing cost if you are planning to use your lease vehicle solely for business purposes.

In the past the car rental tax in New York was not quite as high as it is today. Remember that taxes vary in NY by county so check that yours is indeed 8875 You can save in other ways ie if a dealer in NJ or CT is more competitive. Car leasing and sales tax Unless you live in one of the five states that currently dont charge sales tax Alaska Delaware Montana New Hampshire and Oregon youll have to pay state sales tax to acquire a vehicle.

If you leased the vehicle see register a leased vehicle. In some states such as Oregon and New Hampshire theres no sales tax at. Understand How Car Leasing Fees Charges and Taxes Work.

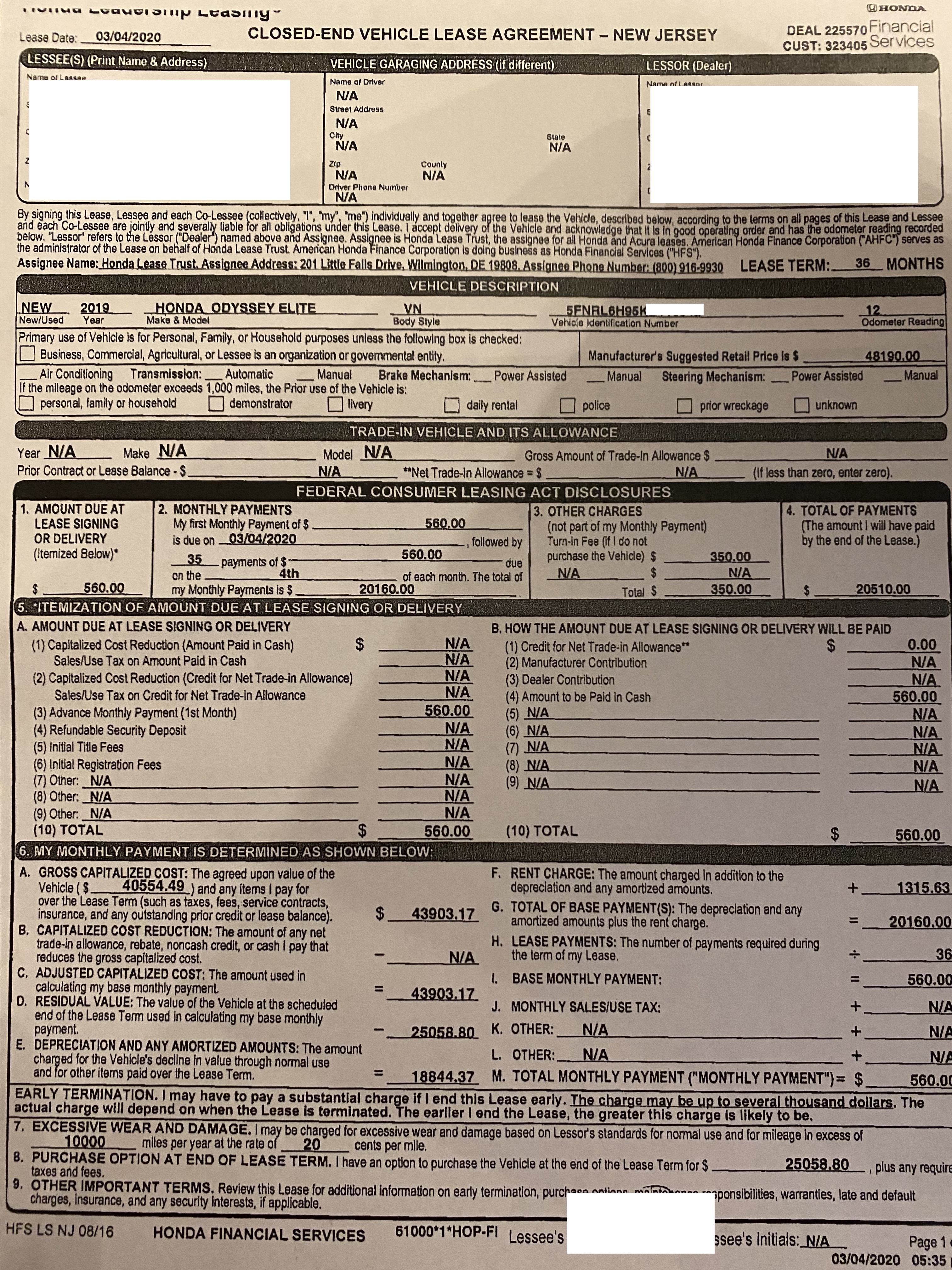

To lease a car in the state of New York means being subject to a different sales tax structure than in most other state. Fees can differ by dealer leasing company and by the statecountycity in which you live. All charges by the dealer including amounts charged by DMV are included in the 550 monthly payment.

The New York Motor Vehicle Retail Leasing Act NYMVRLA is the most comprehensive law in the country protecting consumers who lease new or used vehicles. The same charge or fee can sometimes have different names depending on car company. For vehicles that are being rented or leased see see taxation of leases and rentals.

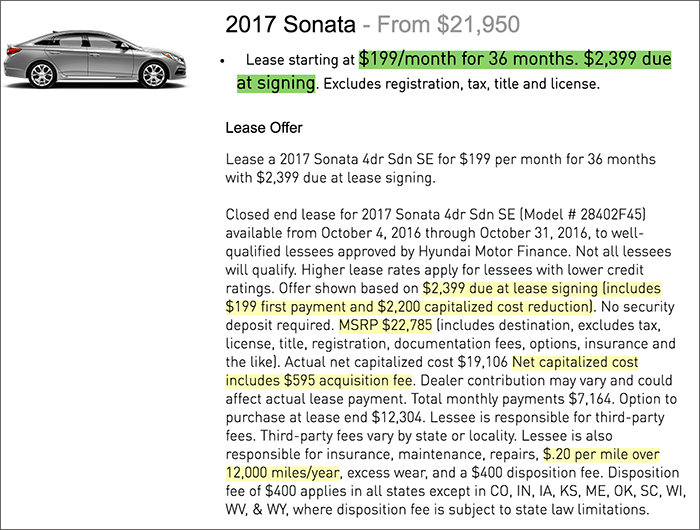

This is true whether you pay cash take out a loan or lease the vehicle. Calculating lease car tax is essential when considering a car lease as most advertised lease specials do not include tax in the lease paymentsBefore contacting a dealership you consider the true value of a car lease by adding sales tax to an advertised lease payment. Person A leases a vehicle from BMW in NYS and NYS sales tax is calculated as the monthly payment NYS sales tax inspection 36 month lease term.

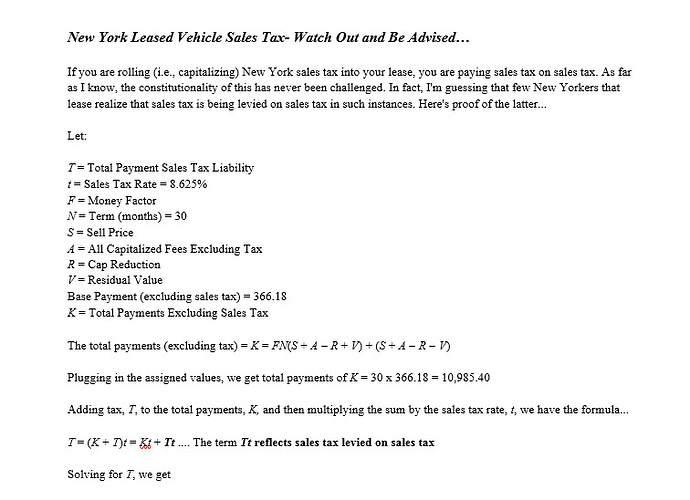

The highest possible tax rate is found in New York City which has a tax rate of 888. New York collects a 4 state sales tax rate on the purchase of all vehicles. Instead of paying all of the sales tax up front Person A opts to roll the tax into the monthly payments increasing the per month price to cover the sales tax and any interest charges.

The dealer determines that the customer will have a lease payment of 550 per month for a period of 36 months. How sales tax is applied in New York. Form ST-10 is not required for a lease transaction.

Most states simply tax any down payment up front and then require that sales tax be applied to each monthly payment. If the vehicle was a gift or was purchased from a family member use the Statement of Transaction Sales Tax Form pdf at NY State Department of Tax and Finance DTF-802 to receive a sales tax exemption. There are also a county or local taxes of up to 45.

The average total car sales tax paid in New York state is 7915. In states that charge sales tax on cars youll have to pay that tax if you lease a car. The DMV calculates and collects the sales tax and issues a sales tax receipt.

The State and local combined sales tax rate in the county where the customer resides is 8. Dealer agrees to lease a vehicle to a customer. When this is added to the already high sales tax of 8375 one can imagine how it will impact the wallets of car.

New Jersey Sales Tax is not due as long as the motor vehicle is not registered in New Jersey. In addition to taxes car purchases in New York may be. When youre leasing a car the rules on when and how much sales tax to pay vary by state.

Currently the car rental tax is calculated at 11 of your total bill. The dealership does not collect New Jersey Sales Tax if the lessee indicates that the primary property location of the motor vehicle is located at an address outside of New Jersey. Not so in New York.

There will no longer be semi-annual tax periods. There are two primary methods used to calculate tax on a car lease. It began as 5 of the total rental bill and has jumped to 11 as of June 2009.

Sales tax due on this lease is computed as follows. The New York Attorney Generals office and The Greater New York Automobile Dealers Association GNYADA are proud of their efforts to make leasing easier to understand and more user friendly for the citizens of New York. Commercial Motor Vehicle Tax CMVT Due to recent legislative changes the annual commercial motor vehicle tax for the owners of medallion taxicabs has been reduced from 1000 to 400.

Nj Car Sales Tax Everything You Need To Know

Leasing Fees Explained In Detail Everything You Need To Know Capital Motor Cars

How Does Leasing A Car Work Earnest

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Mazda Lease Offers In New Rochelle Car Suv Special Lease Deals

2019 Honda Odyssey Elite 560 Monthly 0 Das Ask The Hackrs Leasehackr Forum

Car Leasing Costs Taxes And Fees U S News World Report

Taxes In New York Ask The Hackrs Leasehackr Forum

Signature Auto Leasing Deals And Drive Car Lease Specials

Car Tax By State Usa Manual Car Sales Tax Calculator

How To Lease A Car In 7 Simple Steps New York Daily News

How To Lease A Car When You Have Bad Credit Yourmechanic Advice

Why You Need To Choose Bmw Lease Nj Option Bmw Lease Car Lease Lease

Auto Lease Transfer Swap Lease Brooklyn Nyc

Is It Worth Owning A Car In Nyc Hauseit New York City

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

Sales Taxes Demystified Your Car Lease Payments Explained Capital Motor Cars

Post a Comment for "Car Lease Tax Nyc"